Vossloh intends to expand its product portfolio in Europe by acquiring concrete tie specialist Sateba

Customers will benefit from a higher in-depth system expertise and an expanded portfolio of solutions from a single source.

Vossloh France SAS, a wholly owned subsidiary of Werdohl-based Vossloh AG, yesterday evening signed an agreement with TowerBrook Capital Partners L.P. regarding the acquisition of Sateba Group. Sateba, headquartered in Paris, is one of the leading manufacturers of concrete ties in Europe and has expanded its portfolio in recent years to include other rail infrastructure components and related products. With around 1,120 employees and a total of 19 production sites in ten European countries, Sateba has a production capacity of around four million track and turnout ties per year. In the current financial year, the company expects sales of around €340 million, including the recently acquired Belgian concrete tie manufacturer De Bonte.

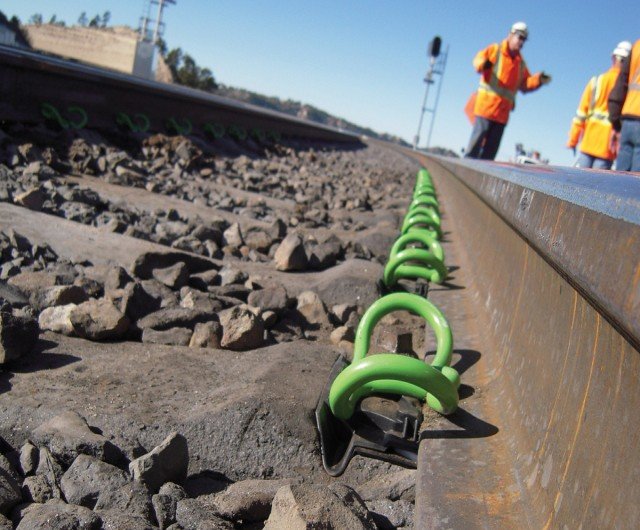

Vossloh already has extensive experience in the concrete tie business in the North American and Australian markets. With the planned acquisition of Sateba, Vossloh also expands its portfolio in Europe. At the same time, Vossloh strengthens its system competence for the rail track, which is key for offering tailored and innovative solutions for higher track availability to customers. With over one hundred years of expertise, Sateba enjoys an excellent reputation and has long been an important and trusted business partner of Vossloh in the areas of switches and fastening systems. Following the completion of the transaction, Vossloh will also expand its customer presence and reach in key European countries. The Tie Technologies business unit, into which the Sateba Group will be integrated, will thus become one of the world's leading manufacturers of concrete ties with annual sales of over €500 million.

"The planned acquisition of Sateba is another important step in the implementation of our corporate strategy. Many of our customers are facing the major challenge of providing the sufficient network capacity for the intended shift of traffic to rail. Thanks to our unique range of innovative and leading-edge products and services and our extensive expertise in all aspects of rail track, we can provide them with comprehensive support. Our customers need strong partners by their side in order to reach the politically and socially desired goal of more sustainable, rail bound mobility. Strong partners like Vossloh," explains Oliver Schuster, CEO of Vossloh AG. He adds: "Sateba is one of the leaders in technology and innovation in our industry and a pioneer in the decarbonization of concrete ties. From tie design and the use of emission optimized types of cement to the use of recycled base materials, sustainability is right at the top of the agenda. This supports our own consequent sustainability strategy and we will also benefit from this in markets outside Europe. I look forward to welcoming my new colleagues to the team once all necessary approvals have been granted."

The transaction will take the form of a share deal. The purchase price (enterprise value) for the acquisition of the company is expected to be €450 million. This purchase price includes the completion of an ongoing acquisition by Sateba in the order of €25 million. Based on the EBITDA expected for the 2025 financial year, this results in a multiple of between 7 and 8. The transaction will be financed by means of bridge financing and a long-term loan. The bridge financing would be predominantly replaced by long-term debt. Subject to suitable market conditions, Vossloh also intends to finance the transaction through a capital increase excluding subscription rights of no more than 10% of the current share capital. The majority shareholder of Vossloh AG has declared its willingness in principle to support such a capital increase through a participation at least in proportion to its current shareholding of 50.09 percent.

Dr. Thomas Triska, CFO of Vossloh: "After the completion of the transaction, Sateba will have a positive impact on earnings per share and supports the achievement of the Vossloh Group's long-term profitability targets. In addition to Sateba's ongoing business, the gradual realization of identified synergy potentials will also contribute to this. Vossloh is aiming for a double-digit EBIT margin in the Group in the long term unchanged. In addition, the ratio of net financial debt to EBITDA should remain well below 2.75 following the implementation of the transaction. With the financing described, we are extremely confident that we will achieve this goal."

The completion of the transaction is subject to regulatory approvals in several countries. In addition, a consultation process with the relevant employee representatives is required under French law before the final share purchase agreement can be signed. All conditions for the completion of the acquisition are expected to be met in spring 2025.

www.vossloh.com